4 Emerging FinTech Trends in 2022

The field of financial technology underwent substantial transformations throughout the previous years. And as the events of the past few years have demonstrated, the world of finance is ripe for upheaval. If we ponder on these emerging fintech trends in 2022, we would also have to put into consideration, its opportunities and challenges.

Even though we’ve seen the middle of the year 2022, I anticipate the increased rate of digital change and innovation will not stop now. The remaining months are projected to deliver a further boost. These trends in FinTech will undoubtedly affect everything that has to do with money, from transactions to banking.

If security measures, as well as rules and other national norms, are in place, the arms race in Fintech and bank consolidation will continue to go strong and the competition to win over customers will pick up its pace. Heightened regulatory focus on many facets of the Financial Technology Industry will be inevitable and with this, every business will eventually evolve Into a Fintech.

Top Emerging Trends in Financial Technology

More widespread use of AI (Artificial Intelligence)

AI is being implemented in today’s FinTech businesses to achieve greater efficiencies, higher levels of precision, and faster query resolution times.

At a compound annual growth rate (CAGR) of 25.9 percent between 2021 and 2022, the size of the worldwide AI in the FinTech market was projected to increase from $7.25 billion in 2021 to $9.13 billion in 2022. At a compound annual growth rate of 27.6 percent from 2018 to 2026, the size of the worldwide AI in the FinTech market is projected to reach $24.17 billion.

It should come as no surprise, then, that in recent years it has placed a significant amount of reliance on artificial intelligence (AI) and machine learning (ML) for strategic decision making, customer insights, understanding consumer purchasing behavior, and improving the digital transaction experience.

Based on global statistics, 660 Fintech Companies as of 2022, now use Artificial Intelligence.

Opportunities: AI is put to use in many different aspects of the financial technology industry, including the decision-making process for lending, providing customer service, detecting fraud, determining credit risk, assessing insurance premiums, managing wealth, and many more applications.

By 2030, it is anticipated that AI would cut bank operational costs by 22%. This might result in $1 trillion in future savings.

Challenges: The road to this perspective is not simple, though. Banks are facing a shortage of workers with all-AI skills, much like the rest of the world’s employers. According to recent HR figures, AI specialists are simply the tip of the iceberg in terms of the world’s labor force.

Increased Regulation On FinTech Companies

One of the industries that are among the most severely regulated in the world is the banking sector. It is expected that the introduction of blockchain technology would further attract the attention of governments all around the world.

The proliferation of cyberattacks will compel countries to increase the amount of regulation placed on the financial technology industry. There will be an increase in the level of regulatory scrutiny since FinTech is becoming increasingly important in the lives of average people.

Opportunities: with the look of things, there will be new representatives in many of the agencies that look at financial services companies which I believe will eventually result in increased regulation of FinTech companies, particularly in the developing spheres of BNPL ( Buy Now Pay Later) and crypto.

Challenges: Due to the substantial rise in regulatory charges compared to revenues and credit losses that have taken place in the banking industry since the 2008 global economic disaster, regulatory compliance has been one of the major concerns that the industry faces.

Compliance may put a major demand on the resources of a FinTech bank, and it frequently depends on the capacity to correlate data from a variety of different sources.

Only-Digital Banking

In the last months of 2022, I presume there would be an imminent shift to only-digital banking. The world of finance is quick to take notice when a bank that only exists in the virtual world offers international payments, peer-to-peer transfers, contactless MasterCard with no transaction costs, as well as the option to buy and sell cryptocurrencies.

Opportunities: With this trend, there is no need to waste even a single second visiting a traditional bank, and there are no nerve-wracking paperwork requirements to contend with. Resetting PINs without leaving the comfort of your own home, paying bills by just taking a picture of the receipt, obtaining real-time analytics, accessing convenient cost management tools, and the ability to quickly examine account balances are opportunities that come with the use of digital-only banks.

Challenge: Although there is a drastic decrease in the number of customers who physically enter a bank, largely as a result of digital-only institutions. However, when customers of a digital-only bank need to resolve continuing issues with the bank, the absence of a physical presence can provide a challenge and make one forget the earlier initiated convenience.

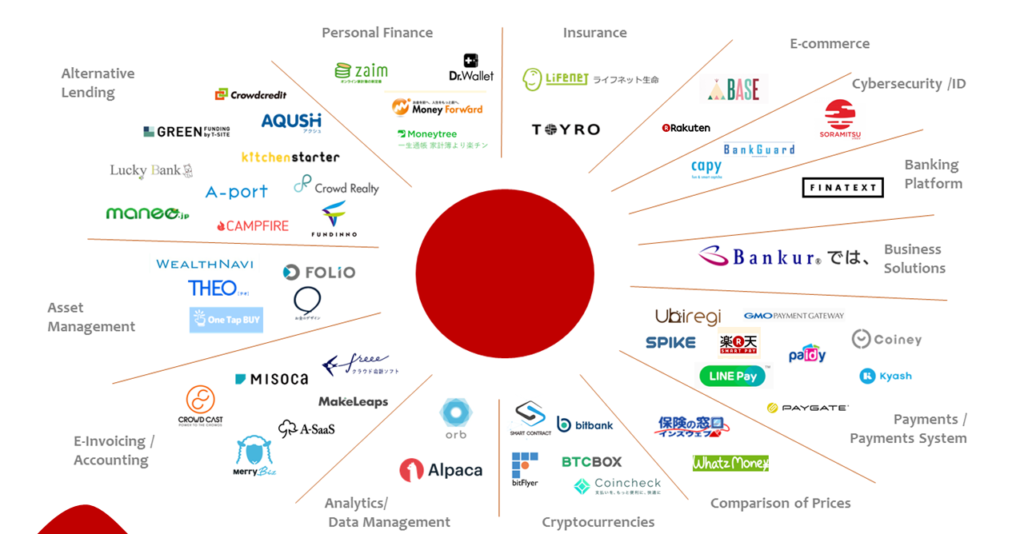

Biggest fintech companies in 2022

Increased Rate of Partnership and Consolidation

Startups in the FinTech business and well-established companies will, in response to the necessity of collaboration, make concerted efforts to collaborate on reshaping the financial industry. The weaker community and local banks, which are caught between the larger banks and the FinTech companies, will then attempt to integrate.

Opportunities: To establish a footing in the burgeoning digital-only banking business, venerable brands in the financial services industry may choose to make investments in FinTech companies. We will see a greater emphasis placed on digital banking solutions that are specifically crafted to meet the needs of individual consumer categories.

Challenges: Although this trend poses no threat to the economy, there might be an issue of differences in the policies of merged companies. In addition, there is a risk of increased rate of joblessness due to layoffs that will most likely occur after consolidation.

Final Thoughts on the Emerging FinTech Trends in 2022

The high rate of innovation that occurs within the FinTech industry’s intricate ecosystem, which involves a variety of stakeholders such as banks, financial service providers, and start-up companies, is one of the industry’s defining characteristics.

To complete what has already been started, a financial institution will work on eliminating as many obstacles as possible regarding banking and payment to provide customers with a more streamlined experience. FinTech has come to stay, thrive, and is for all.